When Do I "Swing Trade"?

The Swing Trading strategy shows its strength when a clear market trend has been established but there's still volatility and rapid price changes. In contrast to "Buy and Hold," Swing Trading works better when market is moving in "waves", which allows our algorithm for easier detection of a trading asset's fair price.

This method also appeals to traders who prefer to periodically harvest their profits, rather than locking up the majority of their assets into long-term investments. Swing Trading enables this, providing periodic profit-taking opportunities.

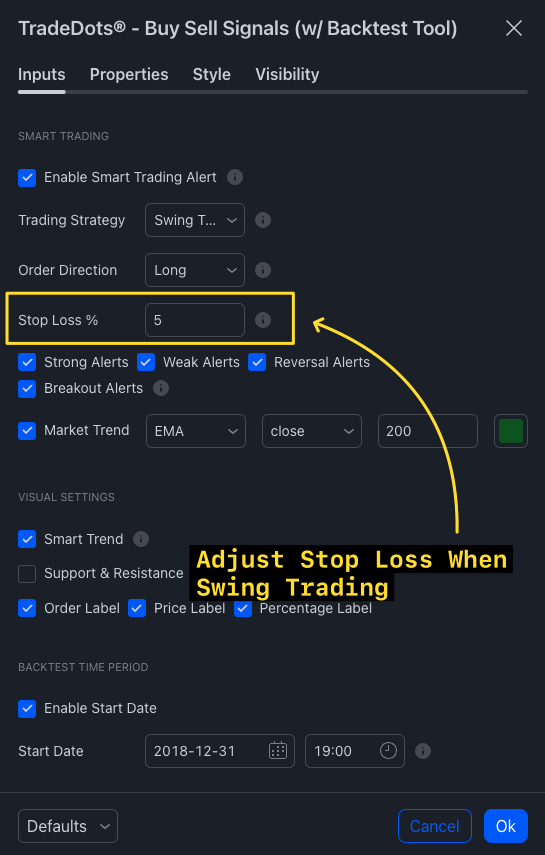

However, a challenge with Swing Trading is choosing the right parameters for stop loss. If the risk tolerance isn't set high enough, traders may encounter frequent stop-outs. Conversely, setting a large stop loss exposes traders to more significant risk and potential resistance to taking a loss, which ultimately might yield lower returns compared to the "Buy and Hold" method.

TradeDots' backtesting tool offers a solution to this challenge by presenting real-time back-test results with different stop-loss percentages for various trading assets. Utilizing the liquidity curve and drawdown data, traders can optimize their stop-loss parameters for the strategy.

Nonetheless, traders must always remember that past performance doesn't guarantee future results. Since markets can flip at any moment, influencing market volatility, the stop-loss number may require dynamic adjustment based on market performance.

Understanding these limitations and adapting to them is essential for long-term profitability when utilizing trading signals.

Note: All scripts and indicators offered by TradeDots are intended for educational and informational use. Past performance is no guarantee of future results.